Is Islamic Banking Really Halal Or A Cosmetic Change of Interest To Profit?

Experts argue that many Islamic financial products are simply conventional products with a Islamic label attached. However, there are exceptions. What makes it different and ties with Islamic principles? Let’s delve into the subject and we have with us Haris Irfan, a leading expert in Islamic finance, who has had a distinguished career in the industry. As the co-founder of Deutsche Bank’s Islamic finance team and former Global Head of Islamic Finance at Barclays, Irfan has been at the forefront of shaping the Islamic finance landscape. In his book, *Heaven’s Bankers*. He explores the rise of Islamic finance and its potential to create a more equitable and sustainable financial system. In a recent media appearance, Irfan argued that the Islamic finance industry must move beyond cosmetic changes and truly embody the principles of Islamic finance.

Irfan’s career in Islamic finance spans over two decades, during which he has worked with some of the largest financial institutions in the world. At Barclays, he played a key role in establishing the bank’s Islamic finance division, which has become a major player in the industry. His experience and expertise have given him a unique insight into the workings of Islamic finance, and he is well-placed to address the criticisms that have been levelled against the industry.

One of the primary criticisms of Islamic banking is that it simply replaces the term “interest” with “profit” without making any substantial changes to conventional banking practices. Irfan acknowledges that this criticism is valid, but argues that it is not entirely accurate. “Islamic finance is not just about changing the label from ‘interest’ to ‘profit’,” he says. “It’s about adopting a fundamentally different approach to finance, one that is based on real asset-backed investments and risk-sharing.”

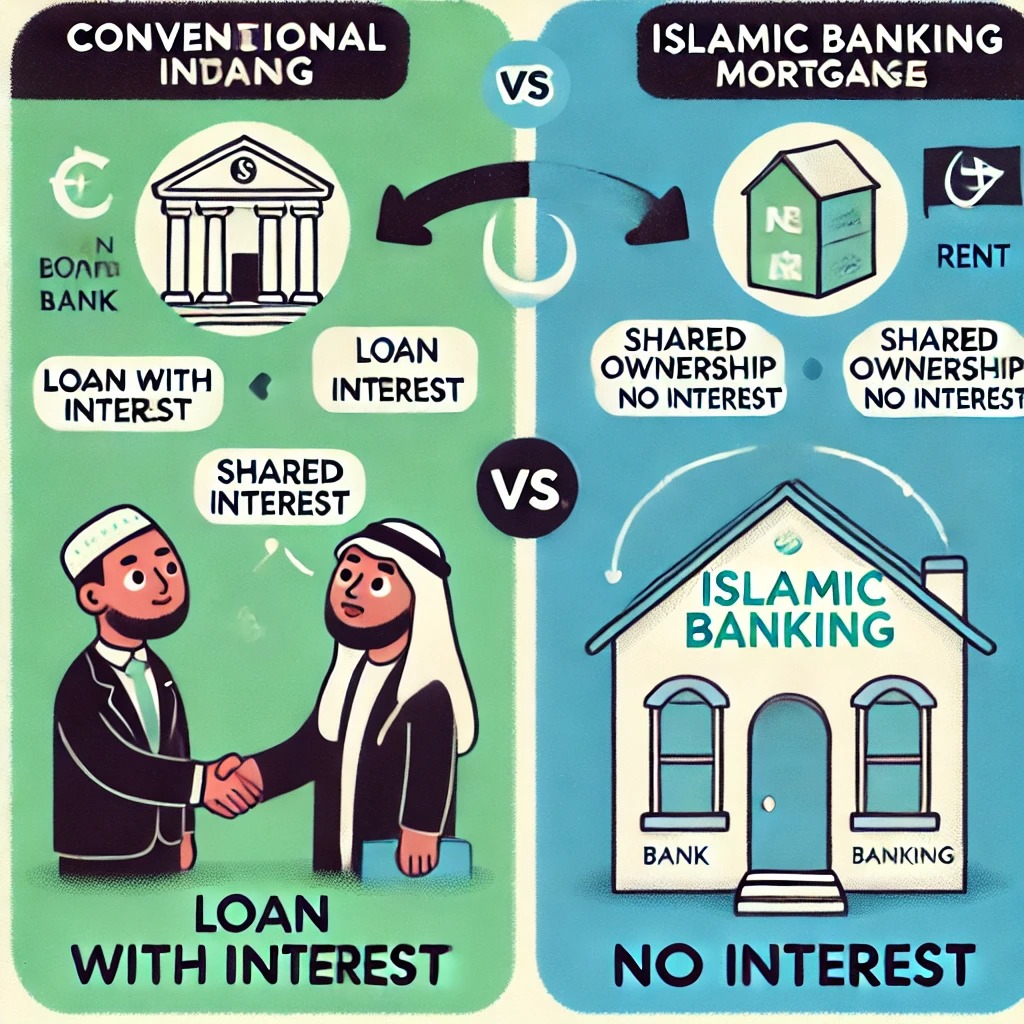

Irfan uses the example of a mortgage to illustrate the difference between conventional and Islamic banking. In conventional banking, a mortgage is essentially a loan from the bank to the borrower, with the bank earning interest on the loan. In Islamic banking, the bank does not lend money to the borrower, but instead enters into a partnership with the borrower to purchase the property. The bank and the borrower share the risk and the profit, with the bank earning a return based on the rental income from the property.

This approach, known as “Mudarabah”, is a key principle of Islamic finance. It allows the bank to earn a return on its investment, while also sharing the risk with the borrower. This approach is more equitable and sustainable than conventional banking, where the bank bears little to no risk and earns a fixed return regardless of the performance of the investment.

However, Irfan also acknowledges that the Islamic finance industry has not always lived up to its ideals. Many Islamic financial products, he argues, are simply conventional products with a Islamic label attached. “This is not Islamic finance,” he says. “This is just conventional banking with a different label.”

Irfan cites the example of “commodity murabaha” as a product that has been widely criticised for being un-Islamic. Commodity Murabaha is a financial product that allows companies to raise funds by selling commodities, such as metals or agricultural products, to a bank at a markup. The bank then sells the commodities back to the company at a higher price, earning a profit. While this product is Shariah-compliant, Irfan argues that it is essentially a form of interest-bearing loan, and is therefore un-Islamic.

To truly embody the principles of Islamic finance, Irfan argues that the industry must move beyond these types of products and adopt a more radical approach. This means focusing on real asset-backed investments, sharing risk with borrowers and investors, and promoting fairness and transparency in all financial transactions.

Frankly speaking, while Islamic banking faces valid criticisms, Irfan believes that the core principles of Islamic finance are sound and have the potential to create a more just and sustainable financial system. However, the industry must strive to fully embody these principles, rather than simply adopting conventional banking practices with a Islamic label. As Irfan says, “Islamic finance is not just about changing the label, it’s about changing the way we do finance.”